(MENAFN- Baystreet.ca) The trade warbetween the United States and China has taken a turn for the worst…

Energy stocks are down, manufacturing is taking a beating, even the almightyFAANG stocks are reeling.

And it's going to get much worse before it gets better.

That's why investors are scrambling back into safe haven assets. And why goldhas barreled past the $1,500 mark for the first time in nearly 7 years.

This summer's gold rush has made the now extra-precious metal's gains for thisyear more than 18 percent. That's better than the S & P 500!

It would be difficult to find a market more bullish than gold right now.

Some areeven sayingthat $2,000/oz gold maybe on the horizon.

The market for gold has never been hotter, and there has rarely been such goodreason to begin buying in.

But catching the trends is no easy feat. From under-the-radar mines to oldschool producers stepping up their game, knowing where to look is the surestway to see big returns.

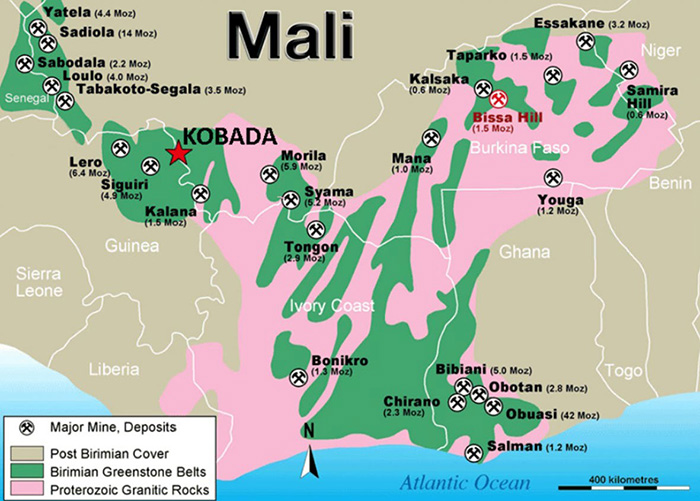

The Next Mining Hotspot

Toronto-based African Gold Group ( TSX:AGG.V , OTCMKTS:AGGFF ) is sitting on anestimated 2.2 million ounces of mineral resources in Mali, a country that iscurrently experiencing its own veritable gold rush.

Thecompany burst onto the scene when they uncovered a massive gold nugget weighing1 kilogram --a single discovery worth$45,400. While this seems like a one-off stroke of luck, for African Gold Groupit was just the beginning.

Soon after, they found a second, even larger nugget, this one weighing 2.7kilograms, and valued at a whopping $122,500.

It must be said that African Gold Group is a junior miner, and while investingin startups comes with its fair share of risks, African Gold Group offerspotentially outsized rewards.

What's more, while the company is new, it certainly isn't green.Newly appointed CEO Stan Bharti is aveteran of the gold game, with 30 years of success at the head of differentmining ventures.

And as a newcomer to the scene, the company appears significantly undervalued,meaning that they have the one thing that every investor is after: discountgold.

We're talking about a stock that has a modest market cap of around $12 million,but is currently sitting on gold reserves estimated to be worth billions.

African Gold Group's Kobada mine is in a prime locationon top of Mali's proven 2.2 million ounces of mineral reserves, and it's anopen-pit operation, which translates to lower operating costs.

And the company estimates theproperty where these gold nuggets were unearthed has2.2 million ounces.And there could even be more, depending on what new testsmay reveal.

As Pope & Companynoted , "Thegold at the Kobada deposit is coarse and nuggety, which means the containedgold content is often under estimated."

Low overhead, huge gold reserves, and a gold price approaching $1,500/oz. meansone thing: African Gold Group ( TSX:AGG.V , OTCMKTS:AGGFF ) will not fly under theradar for much longer.

Gold Giants Ramp Up Production

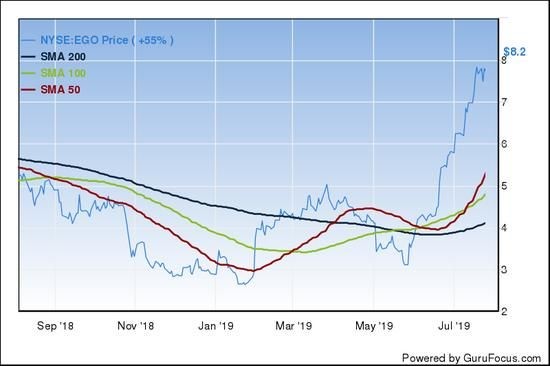

Eldorado Gold Corp. (NYSE:EGO) (ELD.TO) isnot new to the gold world. The company has assets in Canada, Turkey, Greece,Romania, Brazil and Serbia and is expanding.

GuruFocus, an investment news site, asserts that Eldorado is "well-positioned tobenefit from an up-trend in gold" and that "the Canadian miner isgoing to feed the goldmarketwith higher gold volumes over the third and final quarter of 2019, having confirmedits expectations for full-year production of 390,000 to 420,000 ounces."

Eldorado has already produced 174,780 ounces of gold inthe first half of this year, and after the company confirmed its heftyend-of-year projections, it serves to reason that the company will be miningeven more gold in the last two quarters--to the tune of 107,600 to 122,610ounces of gold each quarter--meaning that the company is set to grow between17.2 and 33.6 percent.

A significant part of this production increase will come from Eldorado Gold Corp.'s newly operational Lamaque gold mine in Val-d'Or, Quebec. While a spike inproduction from the Lamaque mine is nearly guaranteed, Eldorado could receivea further production push from its Olympias asset in Greece which also showsmajor potential for growth.

Over the last year, Eldorado's stocks have climbed a whopping 55 percent. Andthis is just the beginning.

George Burns, Eldorado's President and CEO stated: "As a result of the team'shard work in 2018, we are well positioned to grow annual gold production toover 500,000 ounces in 2020." The timing is perfect to buy into Eldorado beforeproduction explodes.

YamanaGold (NYSE:AUY) (YRI.TO) , much like Eldorado,is currently hard at work to ramp up its own gold production.

The Toronto-based company recently finished developing its Cerro Moro projectin Argentina, where the mine produced its first gold and silver in May of lastyear. By the end of the year, Yamana projects, thecompany's gold production will increase by 20 percent and silver production isdue to increase by an incredible 200 percent.

Now, the company is working on developing a brand new project, also inArgentina, called the Agua Rica mine. Yamana signed a deal with Glencore andGoldcorp to initiate the project, which is projected to have a mine life ofover 25 years with an annual average production rate of around 236,000 metrictons (or 520 million pounds) of copper-equivalent metal over the first decadeof operation. This total will include contributions of gold, molybdenum,and silver.

Zacks Investment Research has called Yamana " a great momentum stock ," saying that all thenumbers for the company are right, promising long-term growth.

"Sharesof Yamana Gold have increased 63.94 percent over the past quarter, and havegained 12.54% in the last year. On the other hand, the S & P 500 has onlymoved -2.93 percent and 2.2 percent, respectively."

Not convinced yet? Yamana is also a 50 percent owner of Canada's largest goldmine, the Canadian Malartic.

And who owns the other half of the largest gold mine in Canada? That would beanother Toronto-based gold producer, Agnico Eagle Mines (NYSE:AEM) (TSX:AEM) .

Agnico is thefourthlargest gold mining stockon major U.S. exchanges according to the MotleyFool. It therefore goes without saying that the company is already a big fishin the gold sector, with eight fully-operational mines spread across Canada,Finland, and Mexico.

The company's 50 percent stake in the massive, open-pit Canadian Malartic isprobably the most significant asset in Agnico Eagle's portfolio, but it'scertainly not the only one. Agnico Eagle has a lot going for it.

As the Motley Fool writes, "much of Agnico Eagle's popularity among investorscomes from its near-term potential for rising production. The company hasinvested in assets in the Canadian Arctic territory of Nunavut, and itsMeliadine and Amaruq mines are only now starting to add to total production forAgnico Eagle.

In addition, shareholders in Agnico Eagle benefit from one of the longest trackrecords of dividend payouts in the industry."

Agnico Eagle's dividends make the company a standout among gold producers,which typically struggle to provide dividends after the significant capitalexpenditures required in the gold mining industry.

Not only has Agnico Eagle managed to pay out a dividend for a whopping 36years, their CEO Sean Boyd has long said it is a company priority to increasethe payout.

"With attractively low all-in sustaining costs for gold production that couldwell go down as new assets come fully online," says the Motley Fool, "AgnicoEagle is in a good position to stand out just below the industry's mostprominent mining companies."

Taking A Global Approach

Like Agnico Eagle Mines, Kinross Gold Corporation ( NYSE:KGC) (TSX:K) has also secured a position in the MotleyFool's list of the10biggest gold mining stocks on major U.S. exchanges , comingin at lucky number seven.

Kinross has a much more global view than many of its compatriot companies. Infact, Kinross has no current projects operating in Canada, but instead hassignificant exposure to the United States, Brazil, Russia, Mauritania, andGhana. This is all without mentioning the company's numerous exploration sites,most notably in Chile.

"Kinross has ambitious plans for mining success," says the Motley Fool. "Thecompany expects annual production of roughly 2.5 million ounces of gold, withall-in sustaining production costs of close to $1,000 per ounce. More than halfof its overall production is likely to come from its Western Hemisphereoperations, with between 20% and 25% each coming from West Africa and Russia."

Kinross also has excellent timing, having announced the acquisition of a $283 million Russian goldprojectlastweek, just before gold prices took off. Kinross is a safebet for investors, with its established position in the industry and impressiveportfolio. But now, with significant new projects underway and gold marketspromising to keep growing as the stock market slows, the timing couldn't bebetter to invest.

Diversification Is Key

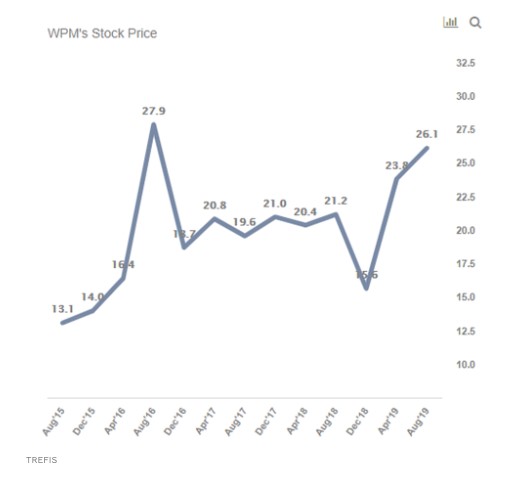

For investors looking for something a bit different, Wheaton Precious Metals (NYSE:WPM)(TSX:WPM) offers a unique take on the miningmarket. Massive and well-established, Wheaton has a hand in operations aroundthe globe and a secure position as one of the largest ‘streaming' companies onthe planet. The Vancouver-based company currently has agreements with 19operating mines and a further 9 projects still under development.

If there was any doubt as to the viability of Wheaton's somewhat unique‘streaming; business model', incredulity will quickly be shut down by thenumbers. Wheaton's stock value has doubled over the past four years thanks tohigher revenues and a sharp rise in margins.

Wheaton has earned itself manyheadlines this week as the stock soared from gold's surge and escalating tradewar refugees sought refuge in gold. Key in quite a few of those articlesfocusing on Wheaton's big moment this week is Schaeffer's Investment Research'sassertion thatnow is the time to buy into Wheaton , as the company "recently flashed a historically bullish signalsuggesting traders may want to consider scooping up call options ahead ofearnings this week."

By James Burgess

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT. This communication is a paidadvertisement. Oilprice.com, Advanced Media Solutions Ltd, and their owners,managers, employees, and assigns (collectively "the Publisher") is often paidby one or more of the profiled companies or a third party to disseminate thesetypes of communications. In this case, the Publisher has been compensatedby2227929 Ontario Inc. to conduct investor awareness advertising and marketingconcerning African Gold Group. Inc.2227929 Ontario Inc. paid the Publisherfifty thousand US dollars to produce and disseminate this and other similararticles and certain banner ads.This compensation should be viewed as a majorconflict with our ability to be unbiased.

Readers should beware that third parties, profiledcompanies, and/or their affiliates may liquidate shares of the profiledcompanies at any time, including at or near the time you receive thiscommunication, which has the potential to hurt share prices. Frequentlycompanies profiled in our articles experience a large increase in volume andshare price during the course of investor awareness marketing, which often endsas soon as the investor awareness marketing ceases. The investor awarenessmarketing may be as brief as one day, after which a large decrease in volumeand share price may likely occur.

This communication is not, and should not be construed tobe, an offer to sell or a solicitation of an offer to buy any security. Neitherthis communication nor the Publisher purport to provide a complete analysis ofany company or its financial position. The Publisher is not, and does notpurport to be, a broker-dealer or registered investment adviser. Thiscommunication is not, and should not be construed to be, personalizedinvestment advice directed to or appropriate for any particular investor. Anyinvestment should be made only after consulting a professional investmentadvisor and only after reviewing the financial statements and other pertinentcorporate information about the company. Further, readers are advised to readand carefully consider the Risk Factors identified and discussed in theadvertised company's SEC, SEDAR and/or other government filings. Investing insecurities, particularly microcap securities, is speculative and carries a highdegree of risk. Past performance does not guarantee future results. Thiscommunication is based on information generally available to the public, anddoes not contain any material, non-public information. The information on whichit is based is believed to be reliable. Nevertheless, the Publisher cannotguarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The owner of Oilprice.com ownsshares and/or stock options of the featured companies and therefore has anadditional incentive to see the featured companies' stock perform well. Theowner of Oilprice.com has no present intention to sell any of the issuer'ssecurities in the near future but does not undertake any obligation to notifythe market when it decides to buy or sell shares of the issuer in the market.The owner of Oilprice.com will be buying and selling shares of the featuredcompany for its own profit. This is why we stress that you conduct extensivedue diligence as well as seek the advice of your financial advisor or aregistered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication containsforward-looking statements, including statements regarding expected continualgrowth of the featured companies and/or industry. The Publisher notes thatstatements contained herein that look forward in time, which include everythingother than historical information, involve risks and uncertainties that mayaffect the companies' actual results of operations. Factors that could causeactual results to differ include, but are not limited to, changing governmentallaws and policies, the success of the company's gold exploration and extractionactivities, the size and growth of the market for the companies' products andservices, the companies' ability to fund its capital requirements in the nearterm and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading thiscommunication, you acknowledge that you have read and understand thisdisclaimer, and further that to the greatest extent permitted under law, yourelease the Publisher, its affiliates, assigns and successors from any and allliability, damages, and injury from this communication. You further warrantthat you are solely responsible for any financial outcome that may come fromyour investment decisions.

TERMS OF USE. By reading this communication you agreethat you have reviewed and fully agree to the Terms of Use found herehttp://oilprice.com/terms-and-conditions Ifyou do not agree to the Terms of Usehttp://oilprice.com/terms-and-conditions ,please contact Oilprice.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. Oilprice.com is thePublisher's trademark. All other trademarks used in this communication are theproperty of their respective trademark holders. The Publisher is notaffiliated, connected, or associated with, and is not sponsored, approved, ororiginated by, the trademark holders unless otherwise stated. No claim is madeby the Publisher to any rights in any third-party trademarks.

MENAFN2208201902120000ID1098913351