(MENAFN- DailyFX) Aussie, AUD/USD Talking Points: AUD/USDhas been in the midst of a grinding sell-off for the better part of the past nineteen months, including a brutal three-week-run from mid-July into early-August. The past two weeks, however, have shown a penchant for support to hold around the psychological .6750 level. This may bring on a pullback or reversal theme but, as yet, no clear evidence suggests that's close to taking place. DailyFX Forecasts are published on a variety of markets such as theUS Dollarorthe Euroand are available from theDailyFX Trading Guides page . If you're looking to improve your trading approach, check outTraits of Successful Traders . And if you're looking for an introductory primer to the Forex market, check out ourNew to FX Guide . AUD Technical Forecast: Neutral

AUD/USD Catches Support at .6750

It's been a rough year so for AUD/USD and it didn't start out very well, either. We can even extend that back to the beginning of 2018, as there hasn't really been much for Aussie bulls to rejoice since the start of last year.

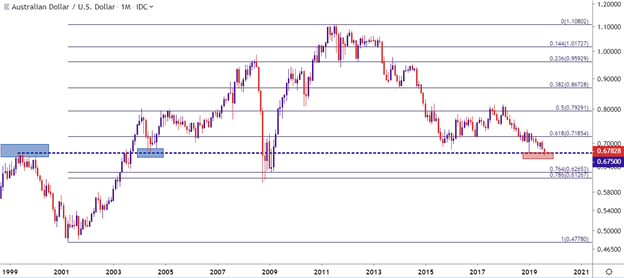

After topping-out above the .8100 level in January of 2018, the pair dropped by more than 1,000 pips over the next nine months. A bit of support early in Q4 helped to stem the declines but, sellers were again ready to pounce after the 2019 open, aggressively enough that a flash crash showed in AUD/USD as prices tipped-down to .6750 to find a bit of support. That price, as it turns out, would continue to carry a pull inAustralian Dollarprice action to go along with a bit of historical intrigue.

AUD/USD Monthly Price Chart

Chart prepared byJames Stanley ;AUDUSD on Tradingview

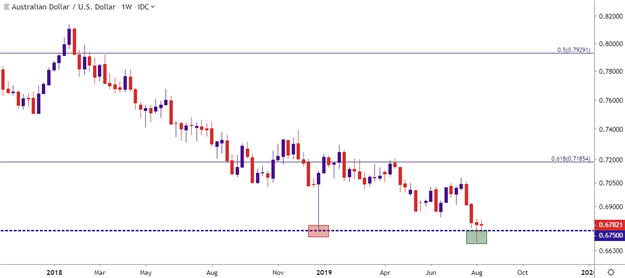

Sellers weren't yet finished after the January flash crash and following a mild bounce, bears came back to drive the pair-lower over the next seven months, bringing us to today… That same .6750 level has helped to hold the lows over the past three weeks and sellers have not yet been able to leave it behind despite an aggressive test-below last week.

AUD/USD Weekly Price Chart

Chart prepared byJames Stanley ;AUDUSD on Tradingview

Have We Seen Capitulation?

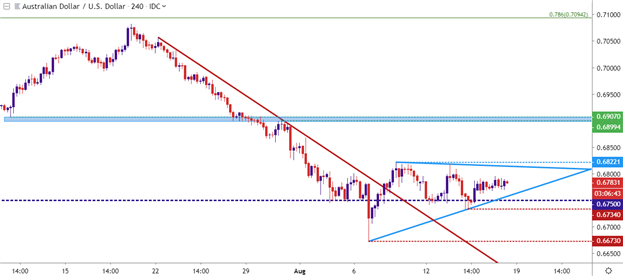

Given that elongated wick from last week's candle and the fact that sellers were unable to re-test below .6750 this week, even with a very strongUS Dollarin the mix, and there's stacking evidence that the bearish trend in the Australian Dollar is coming into question. Whether this brings a retracement or reversal scenario has yet to be seen but, the evidence is enough to move away from a bearish technical bias on the pair until more information presents itself.

For bullish scenarios, a topside break above the August swing high at .6821 could open the door for a trip back towards the .6900 level. This is around the mid-July swing-low and as yet, that prior area of support hasn't shown much for resistance. For bearish strategies, a break of the .6735 swing-low exposes the .6675 area, after which that next swing-low could be sought out around .6625 or perhaps even as deep as .6500. The latter two prices are both levels that haven't been in play since March of 2009; but, at this point, it appears that theme may have to wait for a bit before it comes back into play.

AUD/USD Four-Hour Price Chart

Chart prepared byJames Stanley ;AUDUSD on Tradingview

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? OurDailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources onGoldorUSD -pairs such asEUR/USD ,GBP/USD ,USD/JPY ,AUD/USD . Traders can also stay up with near-term positioning via ourIG Client Sentiment Indicator .

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, ourIG Client Sentimentshows the positioning of retail traders with actual live trades and positions. Ourtrading guidesbring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and ourreal-time news feedhas intra-day interactions from the DailyFX team. And if you're looking for real-time analysis, ourDailyFX Webinarsoffer numerous sessions each week in which you can see how and why we're looking at what we're looking at.

If you're looking for educational information, ourNew to FX guideis there to help new(er) traders while ourTraits of Successful Traders researchis built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter:@JStanleyFX

MENAFN1708201900760000ID1098893539

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.