(MENAFN- DailyFX) GBP price, news and analysis:The new UK Prime Minister, Boris Johnson, has little chance of delivering a Brexit deal with the EU; potentially leading to a no-deal Brexit. That could mean further losses forGBP , particularly if he is forced into a new General Election that could bring the Opposition Labour Party into power or continue the current political stalemate. However, after its recent huge losses,GBPUSDmay now have little further to fall. GBPUSD price outlook: 2017 lows in sight

Incoming UK Prime Minister Boris Johnson is facing the near-impossible task of delivering a Brexit deal with the EU by the latest October 31 deadline, and that could mean more downside forGBPUSD . With the EU refusing to reopen negotiations on the plan agreed with his predecessor Theresa May, Johnson could be forced into a no-deal Brexit and the prospect of no-deal could yet send GBPUSD back to the lows reached in March and April 2017.

From a technical perspective, the key levels to watch on the downside are the 1.2365 low reached in April 2017, the 1.2109 low touched in March 2017 and the 1.1982 low reached in January 2017.

GBPUSD Price Chart, Weekly Timeframe (May 23, 2016 – July 24, 2019)

Chart by IG(You can click on it for a larger image)

Further Sterling (GBP) Weakness Likely if Johnson Becomes PM

Two other possibilities could weaken Sterling further: a snap General Election that could result in victory for the Opposition Labour Party, a large vote for the hardline Brexit Party or further stalemate, and a second Brexit referendum that could be won again by Leave supporters.

Nearer-term, the outlook seems negative too. GBPUSD remains in the downward sloping channel in place since May this year and could well drop to the support line of the channel under 1.24.

GBPUSD Price Chart, Daily Timeframe (May 3, 2019 – July 24, 2019)

Chart by IG(You can click on it for a larger image)

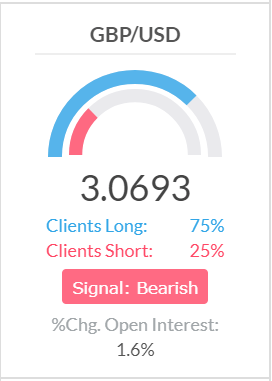

Meanwhile, IG Client Sentiment data are still sending a contrarian bear signal, with retail traders long the pair outnumbering those short by three to one.

IG Client Sentiment (GBPUSD)

Source: DailyFX/IG

It is important to note, though, that after its recent weakness a near-term rally cannot be ruled out as incoming UK Prime Ministers often have a short honeymoon period. If so, a rally back to the resistance line around 1.2550 is possible, although the 14-day relative strength index (RSI) is not yet at the 30 level suggesting that it has been oversold.

Resources to help you trade the forex markets:

Whether you are a new or an experienced trader, at DailyFX we have many resources to help you:

Analytical and educationalwebinarshosted several times per day,Trading guidesto help you improve your trading performance, A guide specifically for those who arenew to forex , And you can learn how to trade like an expert by reading our guide to theTraits of Successful Traders .

--- Written by Martin Essex, Analyst and Editor

Feel free to contact me via the comments section below, via email r on Twitter@MartinSEssex

DailyFX

MENAFN2407201900760000ID1098796796

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.