(MENAFN- DailyFX) Gold Price Talking Points:Gold prices could care less that the US Dollar (via theDXYIndex) is breaking its downtrend from the May high; bullish momentum remains firm. The whipsaw in gold volatility, as measured by the Cboe's ETF, GVZ (which tracks the 1-month implied volatility of gold as derived from the GLD ETF option chain) can be directly tied to thehaywire shifts in Fed rate cut expectations .Retail trader positioning suggests that thegold pricerally may be set to resume.

Looking for longer-term forecasts on Gold andSilver prices ? Check out theDailyFX Trading Guides .

Financial market participants are feeling edgy these days. In the run-up to the July ECB meeting later this week and the July Fed meeting next week in which both central banks are expected to take dovish policy action, traders have been quietly accumulating positions in precious metals like gold and silver. Precious metals rarely outperform other asset classes unless anxiety is starting to grip market participants.

Gold Glittering Around ECB and Fed Meetings

Thanks to the European Central Bank and Federal Reserve, the prospect of short-term European (French OATs, German Bunds, etc.) and US Treasury yields remaining biased lower over the next several months has led to an erosion in real yields. This narrative continues to serve as a fundamentally bullish backdrop for gold prices. Rates markets are predicting 20-bps of rate cuts by the ECB through the end of the year, while it now appears that the Fed will cut rates by 50-bps by December. As has been the case for the past several weeks, swings in rate cut odds will only help gold prices via volatility.

Gold Volatility Edges Up Alongside Rate Cut Odd Volatility

As a measure of uncertainty, gold volatility's recent moves in July can be traced back to the uncertainty created by the US-China trade war and the resulting impact on Fed interest rates. While other asset classes don't like increased volatility (signaling greater uncertainty around cash flows, dividends, coupon payments, etc.), precious metals tend to benefit from periods of higher volatility as uncertainty increases the appeal of gold's and silver's safe haven appeal.

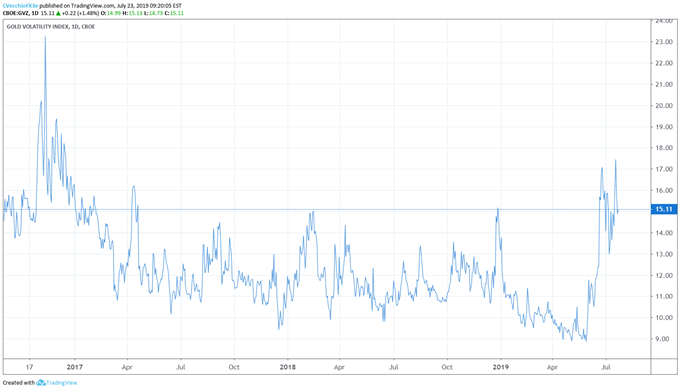

GVZ (Gold Volatility) Technical Analysis: Daily Price Chart (October 2016 to July 2019) (Chart 1)

Gold volatility (as measured by the Cboe's gold volatility ETF, GVZ, which tracks the 1-month implied volatility of gold as derived from the GLD option chain) set a fresh yearly high set last week at 17.45 but has since settled in near 15.11.

Strength in the Face of Adversity

In recent weeks we've suggested that 'stability in the face of adversity – an improved environment for risk appetite – bodes well for gold's future prospects.' This requires a bit of a tweak: gold prices are now exhibiting strength in the face of adversity. Gold prices could care less that the US Dollar (via the DXY Index) is breaking its downtrend from the May high. It's unusual for gold and the US Dollar to rally together; that gold prices are continuing to push higher while the US Dollar does should be a bullish development for precious metals.

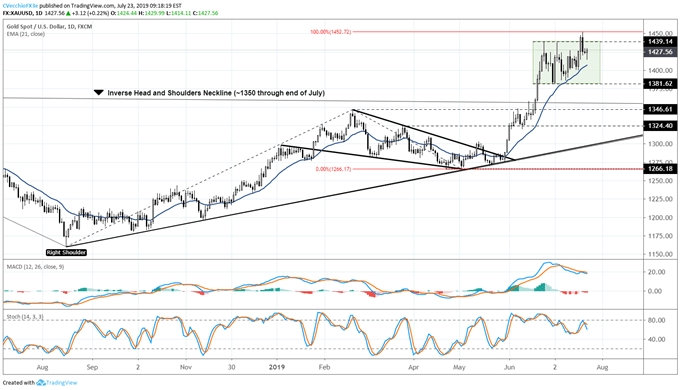

Gold Price Technical Analysis: Daily Chart (July 2018 to July 2019) (Chart 2)

If trading is a function of both price and time, then the lack of significant follow through to the topside may be seen as a corrective measure to help relieve overbought conditions in several momentum indicators. After hitting the 100% Fibonacci extension at 1452.72, gold prices have been meandering around, neither breaking down nor breaking out. Gold prices remain in the 1381.62-1439.14 sideways range that was in place since the June Fed meeting.

Yet with gold prices above the daily 8-, 13-, and 21-EMA envelope, and both daily MACD and Slow Stochastics having worked off their overbought conditions without gold prices retracing their late-May to mid-July advance, it would appear that the path of least resistance remains higher. To this end, unless gold prices lose the daily 21-EMA, a moving average that hasn't been closed below since the bullish outside engulfing bar/key reversal on May 30, then there is still good reason to believe that the long-term bullish forecast (vis-à-vis thebullish inverse head and shoulder's pattern ) remains valid. New highs may be coming soon.

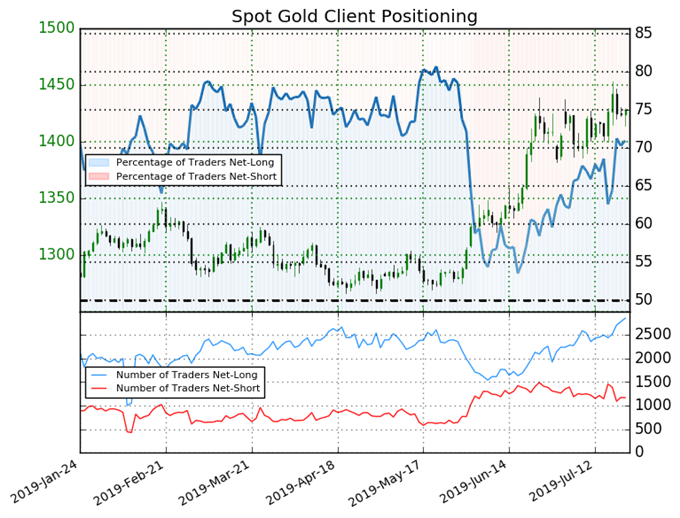

IG Client Sentiment Index: Spot Gold Price Forecast (July 23, 2019) (Chart 3)

Spot gold: Retail trader data shows 70.9% of traders are net-long with the ratio of traders long to short at 2.44 to 1. The number of traders net-long is 1.8% higher than yesterday and 11.1% higher from last week, while the number of traders net-short is 1.8% lower than yesterday and 8.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests spot gold prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger spot gold price bearish contrarian trading bias.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoringtrader sentiment ; quarterlytrading forecasts ; analytical and educationalwebinars held daily ; trading guides to help youimprove trading performance , and even one for those who arenew to FX trading .

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail

Follow him on Twitter at@CVecchioFX

View our long-term forecasts with theDailyFX Trading Guides

MENAFN2307201900760000ID1098793669

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.