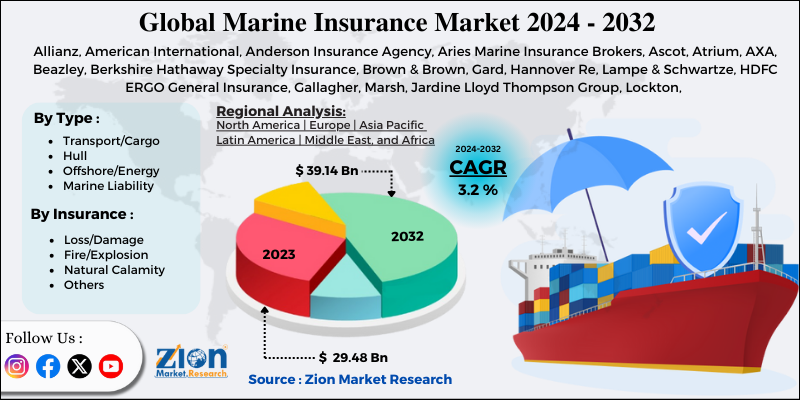

(MENAFN- Zion Market Research) Zion Market Research has published a new report titled 'Marine Insurance Market by Type (Transport/Cargo, Hull, Offshore/Energy, and Marine Liability) and by Insurance (Loss/Damage, Fire/Explosion, Natural Calamity, and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 20182026. According to the report, the global marine insurance marketwas USD 29,440 million in 2018 and is expected to generate around USD 37,819 million by 2026, at a CAGR of 3.2% between 2019 and 2026.

Marine insurance includes the damages or losses caused to terminals, ships, and transport or cargo that acquire, transfer, or hold goods between different points of source and final terminus. The term 'marine insurance also relates to inland marine. However, it is typically used in the setting of marine insurance of ocean. Marine insurance is a haven for shipping and transporters corporations, as it helps to lessen the financial loss burden owing to the loss of cargo. The use of online gateways has enhanced customer experience by introducing advanced technologies in the marine industry, such as analytics and digitization. As a result, numerous countries, such as Singapore, are capable of endorsing insurance business prototypes via online platforms. Moreover, these new digital enterprise podiums involve decreased cost, create an online network distribution, alleviate risks, and offer an improved customer knowledge, which, in turn, propels the rate of revenue generation in the marine insurance market.

Request Sample

Request Customization

Buy Now

Browse the full 'Marine Insurance Market by Type (Transport/Cargo, Hull, Offshore/Energy, and Marine Liability) and by Insurance (Loss/Damage, Fire/Explosion, Natural Calamity, and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 20182026 Report at https://www.zionmarketresearch.com/report/marine-insurance-market

The marine insurance market is fragmented into type and insurance. By type, the global marine insurance market includes transport/cargo, hull, offshore/energy, and marine liability. The transport/cargo insurance segment accounted for a major share, i.e., more than 50%, in 2018 and is expected to register a high growth rate over the forecast time period. This segmental growth can be attributed to the high demand for cargo/transport loading and inspection services are expected to increase in the future, as trade volumes are projected to rise in the next years, which, in turn, will propel the demand for cargo/transport insurers globally. Based on insurance, the global marine insurance market includes loss/damage, fire/explosion, natural calamity, and others. The loss/damage segment accounted for the largest market share, i.e., around 60%, in 2018, due to the increasing marine cases of accidental damages.

By geography, Europe accounted for the largest share of the global marine insurance market in 2018 and is expected to remain dominant over the forecast time period as well. Marine transport is one of the most important drivers of the European economy, as it carries half of Europe's goods and maintains millions of jobs. Thus, there is an increased demand for marine insurance in the region, which is anticipated to boost the growth of the European marine insurance market in the years ahead. Asia Pacific is expected to register the highest CAGR in the future in the global marine insurance market.

Some key players operating in the global marine insurance market are Allianz, American International, Anderson Insurance Agency, Aries Marine Insurance Brokers, Ascot, Atrium, AXA, Beazley, Berkshire Hathaway Specialty Insurance, Brown & Brown, Gard, Hannover Re, Lampe & Schwartze, HDFC ERGO General Insurance, Gallagher, Marsh, Jardine Lloyd Thompson Group, Lockton, Mitsui Sumitomo Insurance, Munich Re, Sirius International Insurance, SOMPO Taiwan Brokers, Swiss Re, Thomas Miller, Tokio Marine Holdings, United India Insurance, Willis Towers Watson, XL Catlin, Zurich Insurance, and Chubb.

This report segments the global marine insurance market into:

Global Marine Insurance Market: Type Analysis

- Transport/Cargo

- Hull

- Offshore/Energy

- Marine Liability

Global Marine Insurance Market: Insurance Analysis

- Loss/Damage

- Fire/Explosion

- Natural Calamity

- Others

Global Marine Insurance Market: Regional Analysis

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

About Us:

Zion Market Research is an obligated company. We create futuristic, cutting-edge, informative reports ranging from industry reports, the company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client's needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us—after all—if you do well, a little of the light shines on us.

Contact Us:

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll-Free No.1-855-465-4651

Email:

Website: https://www.zionmarketresearch.com

MENAFN1805201900703707ID1098537262

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.